Unitarian Universalists have been moving their money in the direction of their values since the 1960s, joining other faith traditions like the Methodist Church. By the time it came to dismantling Apartheid in South Africa, the UUA was in good company with many other socially responsible investors. While small in number, Unitarian Universalists punch way above our weight when it comes to “financial activism.”

Using our money as power

In 1962 the UUA formed the UU Common Endowment Fund to invest assets owned by the UUA, and by member congregations that wanted professional management of their savings. Fast forward almost 60 years through the many social justice movements in our country and today, the UUA Common Endowment is now over $200 million and is one of the most well-known and impactful Endowment Funds around. The socially responsible investment industry has matured and today you CAN have it all: the diversification we need to meet our fiduciary duty while earning market returns AND using our money as power.

By the time I joined the Socially Responsible Investment Committee in 2008, the Investment Committee (IC) and the Socially Responsible Investment Committee (CSRI) were working well together to evaluate the investment options our consultants brought us for our own analysis and approval. Today, the UUA’s Common Endowment is consistently meeting our lofty social and environmental goals as we safeguard the assets of the UUA and our member congregations. Our website that has been designed, and updated monthly, will let you dig into what investing, UU Style, looks like: https://uucef.org/

Investments to suit your values

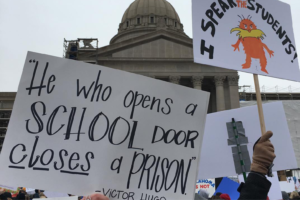

In the UUA Common Endowment we apply many screens to eliminate industries that violate our beliefs: gun stocks and companies that service the prison industry; fossil fuels companies and the companies that contribute to Climate Change. We don’t just divest from companies that don’t line up with our values: we invest the alternative energy companies that will bring us into a carbon neutral economy and we seek the companies that have industry leading LGBTQ + and Gender Equality policies in pay and promotion to the board room. In my first year with the SRI committee, I was able to speak to one of Wal-Mart’s well-known annual meetings: http://socialjustice.blogs.uua.org/bglt/gender-non-discrimination-at-wal-mart/

At General Assembly 2016, we joined a mighty cloud of witnesses in tackling Climate Change, via divesting from fossil fuels: read more about the resolution passed at this GA https://uucef.org/socially-responsible-investing/resources-on-carbon-asset-risk/

We continue to vision how to use our money to impact the social and environmental justice issues that members of our congregations work on and frequently update our Guidelines to include the issues that matter to our members. In 2019, our Investment Committee and the Socially Responsible Investment Committee (which I am a member of) updated our Investment Guidelines to include issues that are front in center, across our congregations: how often do you see an investment fund strive to meet these ideals?

This policy addresses investment criteria on environmental, social and governance issues. In implementing this policy, we are cognizant of the intersectionality of all of these issues, and we are guided by the UUA commitment to advancing racial justice, supporting multi-culturalism and dismantling white supremacy culture, which is a system of wealth, power and privilege that advantages white people and keeps people of color on the margins. As the 2017 Statement of Conscience put it: “The escalation of income and wealth inequity undergirds many injustices that our faith movement is committed to addressing, including: economic injustice, mass incarceration, migrant injustice, climate change, sexual and gender injustice, and attacks on voting rights.”

About Julie Skye:

Julie launched Skye Advisors in December 2017 when she combined her experience with her passion for Sustainable – Impact Investing. Building and managing investment portfolios using the Triple Bottom Line, Skye Advisors…and now Sustainable Advisors Alliance turns money into change agents that enable investors to tackle the issues of our day. Reach Julie at:julie@sustainableadvisorsalliance.com

Today, moving your money in the direction of your values means you can change the world…without giving up investment performance. Next month, I’ll talk about how we engage Corporate America to literally change the face of Capitalism. Here is a preview of our work:

Questions about the UUCEF

Are there certain kinds of companies the UU Common Endowment Fund (UUCEF) will never hold?

For our directly managed investments, we do not hold any companies that derive more than 5% of their revenue from the manufacture/sale of tobacco or weapons, or any companies whose operations support the government of Sudan. The UUA CEF also invests in many pooled vehicles (in which investments are comingled with those of other investors). These comingled funds may not screen out all of the above-mentioned investments, but are necessary to give us exposure to certain asset classes and allow us to meet our return goals, given the relatively small size of the endowment. For pooled vehicles, we seek whenever possible to hire managers who have demonstrated competence in responsible investment.

What about companies that are bad for workers or the environment?

There are broad-based social and environmental screens in place in two areas of our endowment. First, the separately managed accounts where we directly hold US stocks exclude any company ranked in the lowest 5% of its peer by social research firm Sustainalytics, as well as companies facing severe social, environmental, or governance controversies. Secondly, some of the asset managers we employ, such as Boston Common Asset Management, are dedicated SRI firms that build their own social and environmental criteria into stock selection.

What is your position on fossil fuel divestment?

The SRIC unanimously supports the 2014 General Assembly Business Resolution on Fossil Fuel Divestment. See here for a more detailed response. In collaboration with research firm Sustainalytics, we currently apply especially stringent social and environmental screens to our direct energy holdings, ensuring that we invest only in best-in-class energy companies. (We screen all our direct holdings to eliminate the worst actors in each industry, but the energy-sector standards are even more rigorous.) When we invest in pooled vehicles, we question managers about their approach to climate risk and carbon valuation, and prefer those with a more climate-friendly approach.

What other issues are you working on through shareholder advocacy?

The UUA has been a leader in advocating the adoption of employment policies that protect workers from discrimination on the basis of gender identity, as well as sexual orientation. In response to resolutions we have filed at several major US employers, over 3 million workers have gained this kind of nondiscrimination protection over the last few years. In 2014, the UUA led filings for shareholder resolutions on:

- Climate change at seven companies in our portfolio;

- Sexual orientation/gender identity non-discrimination at two companies in our portfolio;

- Political spending/lobbying disclosure at five companies in our portfolio;

- Separation of the Chairman and CEO positions at Chevron; and,

- Human rights at Dow Chemical.

The UUA has consistently voted their shares in support of environmental, social justice, and governance resolutions other coalition partners have filed. For more about this, visit Shareholder Advocacy.

What are our investments doing to decrease poverty and discrimination?

The UUA has pledged up to 5% of its total investments to support Community Development Financial Institutions, which provide access to capital and financial services for underserved people, including low-income communities and communities of color. Part of this set-aside is a matching program for investments in CDFI’s by UUA congregations. Currently twenty-four CDFI’s have received investments, including a community development credit union in Jackson, MS, a community loan fund that provides affordable credit to Native Americans in South Dakota, an association that support the development of healthy rural communities in Louisiana, and a low-interest lender to developers of affordable housing in the Washington DC area. For more information, see the Community Investing and the UU Common Endowment Fund Q&A (PDF) with Marva Williams, member, Socially Responsible Investing Committee.

To learn more, visit the FAQ on the UUA CEF blog: Frequently Asked Questions